Table of Contents

Sometimes due to lack of knowledge on the subject, the Stock Market participants buy some fundamentally weak stocks and hence end up losing a major part of their capital. In this manner, they start avoiding the markets and thus lose out on a good money-making proposition.

So what if we can have an instrument or a screener in which we can scrape out those companies which can erode our invested Capital.

Stocks to avoid investment

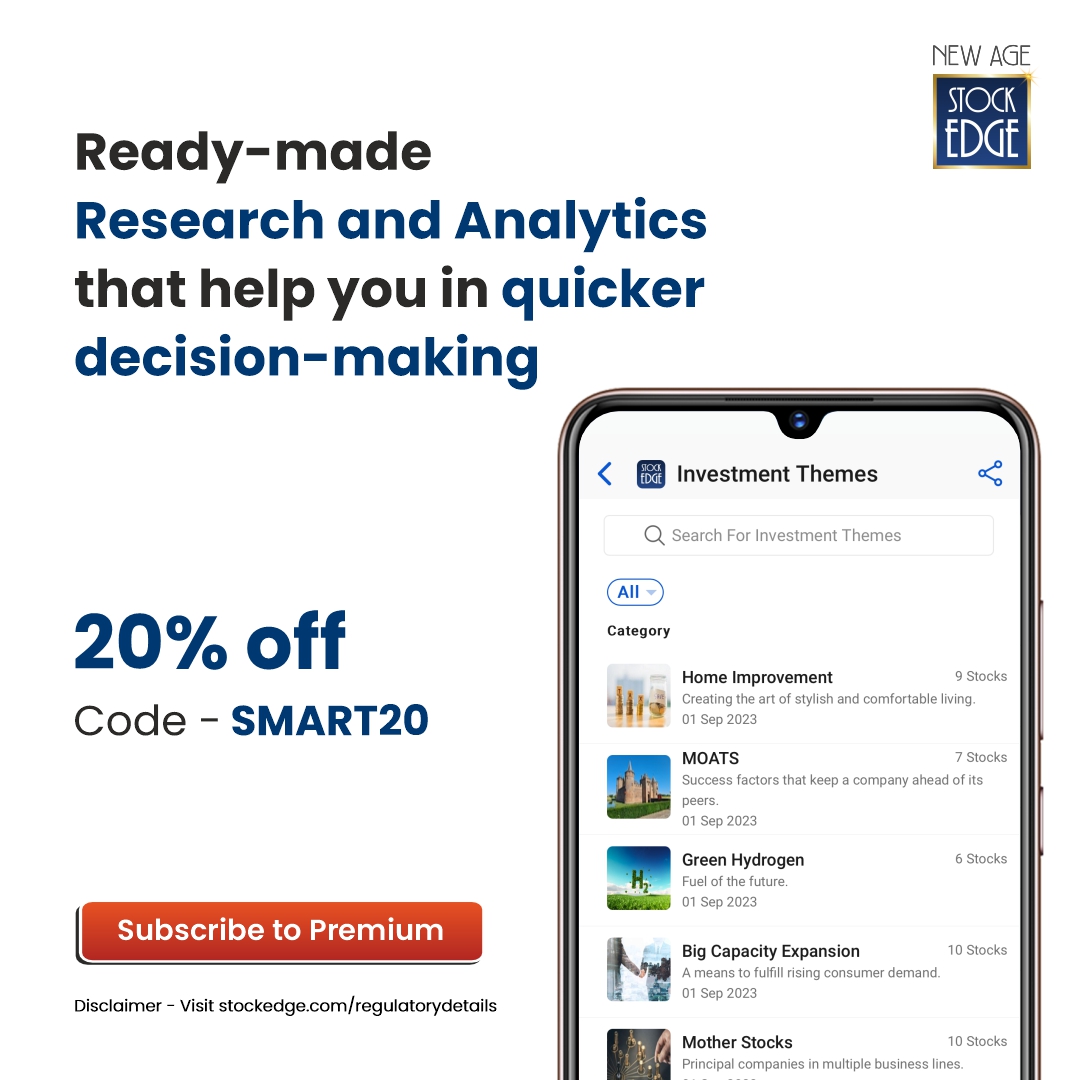

With Stockedge you can scan and identify such companies quite easily by using Combination scans

So what can be the parameters which can be used under combination scans which can give us the required output of weak stocks to avoid.

By using just 4 to 5 parameters one can filter out such companies through Combination scans.

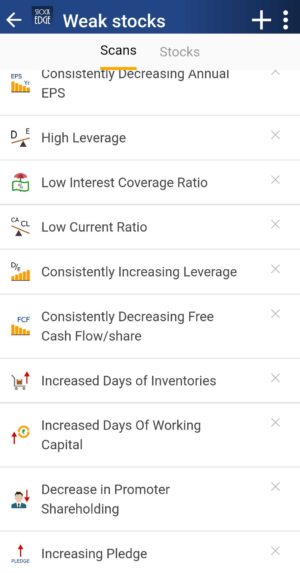

So the scans which could raise a red flag for such companies are the following

Scans

- High Leverage and Consistently Increasing Leverage

- Low Interest Coverage Ratio

- Low Current Ratio

- Consistently decreasing Annual EPS/Quarterly EPS

- Consistently decreasing Free Cash Flow per share

- Increased days of Inventories

- Increased days of Working Capital

- Decrease in Promoter/FII/DII holding

- Increasing Pledge and High Pledge

So these, when put together in different combinations, will give us the knowledge for the stocks to avoid by an Investor or a trader.

Definition

So now let’s understand each one of them.

High Leverage and Consistently increasing Leverage: High Leverage means debt Equity ratio is more than 2 that means any macro or micro changes in the industry to hugely affect the company’s performance. Investors tend to stay away from highly leveraged companies. Consistently increasing leverage is not a good sign, as interest payment burden increases and hence the company’s operation suffers. The high interest cost gets difficult to service whenever there is any change in the interest rate scenario and hence affects the financials.

Low Interest Coverage Ratio: It means that the company to face difficulty during adverse times to meet its interest obligations as Interest coverage ratio is low.

Low Current Ratio: It means the chances for the company to have a deficiency in liquidating its assets for paying of its debt obligations is high. Thus they are those laggards from which the Investor forums tend to stay away. A ratio lower than 0.75 is called as Low Current Ratio.

Consistently decreasing Annual or Quarterly EPS: The EPS depicts the earning of a company relative to its Price which means how much is an investor willing to pay for a rupee of a company’s earning. Thus if the Annual or Quarterly EPS decreases consistently then it means that the company’s earnings are declining and thus not in line to the company’s price per share.

Consistently decreasing Free Cash Flow per share: Decreasing FCF might signal that the company is not able to sustain its earnings growth. An insufficient FCF for earnings growth can force a company to increase its debt levels or not have the liquidity to stay in business.

Increased days of Inventories: It means that the company is unable to convert its goods into sales as it has purchased more than it can sell. Thus the cash flow is impacted negatively if Inventory turnover ratio increases. It raises concern about the company’s ability to convert its inventory to sales in case the ratio continues to increase.

Increased days of Working Capital: If the working capital days of the company is high, it implies that the current assets are tied up for more period of time and thus it can lead to more working capital loan if it continues to increase in the same pace. This is viewed as a negative for the company as the business of the company will be affected affecting the bottomline.

Decrease in Promoter/DII/FII holding: If the Promoter of the company starts selling shares then it is viewed as negative as there might be something weak regarding the working of the company or future prospects. Similarly FII and DII are far smarter people who do their indepth research and if found bad discard the shares and get out of them. Thus these kinds of shares should be best avoided.

Conclusion

Thus use any of these scans in combination and check out if the stocks to avoid. If you are holding them then get out of them as now you know why they were giving you losses and invest into better opportunities.

Click here to know more about the offering of StockEdge Premium